How To Add Money To Roth Ira Vanguard

In this article, I'll walk you through how to open a Roth IRA account and commencement investing at Vanguard using the following steps:

- Open up and fund your business relationship

- Choose your Target Date Fund

- Set up Automatic investments

Why Vanguard?

Vanguard is an awesome company to invest with, especially when it comes to offering low fee, long term investment options. The company'southward founder, Jack Bogle, invented the alphabetize fund, which gives investors admission to a wide range of depression fee investments all rolled into 1 fund. Vanguard is the market leader for long term investors and a great company to trust with your coin.

Before nosotros beginning, make sure yous have at least $1,000 that you can use to fund your account. If you don't accept $1,000, don't worry. Open up an account with Fidelity instead and follow the same procedure. Both companies offer similar investment options, and so choose the 1 that fits into your budget today so you can start investing right now.

ane. Open up and fund your account

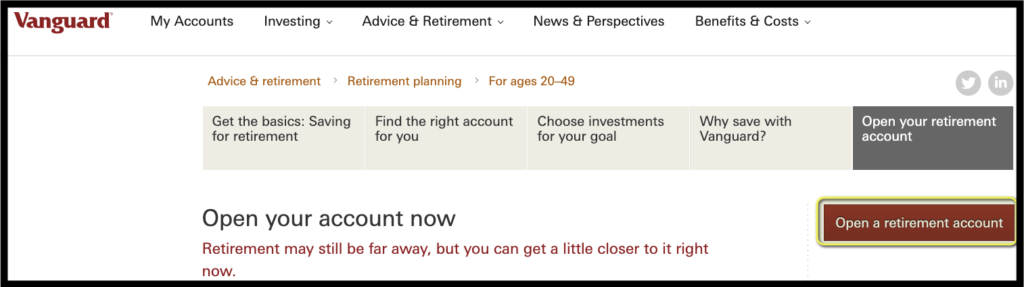

- Head over to Vanguard Retirement Accounts and select Open up a retirement business relationship

- Click No when asked, "Are you registered on vanguard.com?" (You'll gear up your online business relationship at the end of the process)

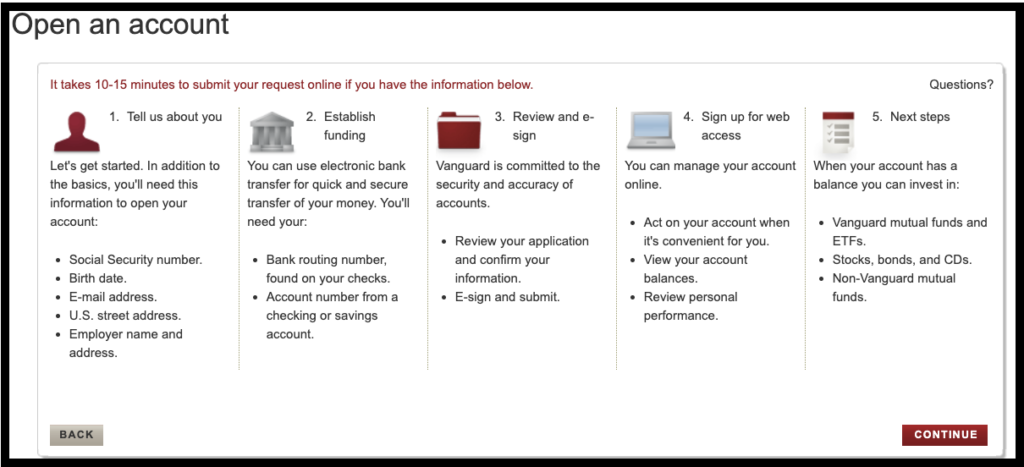

- Make certain you take all of the required info for steps 1 & 2 and then click keep.

- Answer each account question:

- Why are you lot investing? Retirement

- Select Your Business relationship Type: Roth IRA

- What'due south your goal for this money? Choose whatever makes the most sense for you. I chose "Growth & Income" and I too chose "Retirement/Full general Savings" as my source of funds.

- Complete your personal information

- Fund your business relationship:

- Connect the depository financial institution business relationship that y'all are using for your initial eolith. Cull to transfer at to the lowest degree $ane,000 to become the account started

- Sign upward for online access and end the application

A petty bit of waiting..

Vanguard volition demand to validate your banking company account and then transfer the money into your new Roth IRA. This procedure can take a few days then make sure y'all set a reminder to log dorsum into your Vanguard account in 3-four days to complete the investing process. Motility on to the next department to starting time picking out the investments that y'all will use.

ii. Choose your investments

The key to investing success really boils down to "don't put all of your eggs in one basket."

When investing, there will ever be some hazard considering the economy fluctuates upwards and downward, so your investments volition as well. While the money you make year to year might modify, the average stock market return is about 8% per year once you factor in inflation.

To help you ride the moving ridge of twelvemonth to year ups and downs, you'll want to minimize your gamble by choosing investments that span a lot of industries, companies, and even economies. Doing this makes long term investing more reliable and safe, especially if you choose depression-fee investments like the selection I encompass here.

Investing in a Target Retirement Fund

Vanguard Target Retirement Funds are investment funds based on the twelvemonth you expect to retire. Vanguard manages these funds and makes sure that your investments within the fund are diverse and the gamble tolerance is appropriate based on your age. These funds are super depression fee with an expense ratio of around 0.15%. Investing in a Target Retirement Fund ways that you won't have to inquiry multiple funds and choose how much to invest in each, and y'all also won't have to rebalance your investments as you get older – Vanguard does all of this for you.

- Nether option i: "Where'due south the money going?" – you lot will see your Roth IRA Brokerage Account and your initial deposit amount will be listed under your Federal Money Market settlement fund.

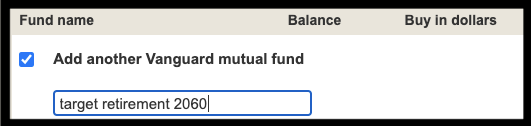

- Select Add another Vanguard Mutual Fund

- Type in the name of the fund you lot desire to invest in

- Once you click on the name, fill in the "Buy in dollars" amount. Enter the full amount of your initial deposit (for example, $1,000). Click keep

- Under choice ii: "Where's the money coming from?" – Choose From my settlement fund (which should be the default choice). Click continue

- Read through the electronic consent information and submit your lodge when y'all are comfortable with your choice.

Congrats, you're invested!

iii. Automate your investments

At present that you invested your initial deposit, it's important to set up automated monthly investments so you can take total advantage of compound involvement – it'due south like money magic for long term investors.

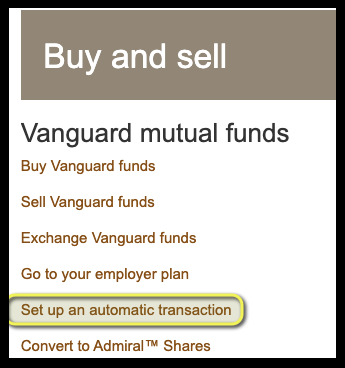

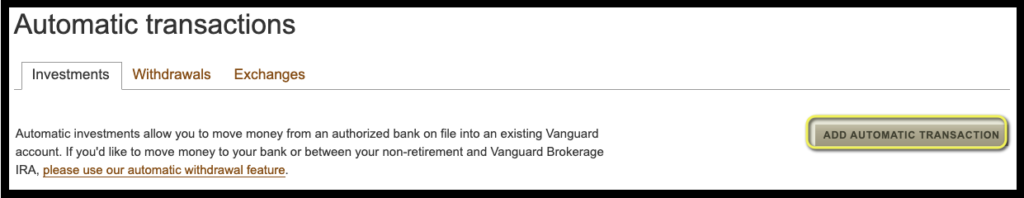

- Hover over "My Accounts," cull "Purchase and Sell," and select Prepare up an automated transaction.

- Click on the beginning selection you see – Automatic investment.

- Select Add together automatic transaction, and cull your new Roth IRA Brokerage Account.

- Move money from banking company account. Correct below this you volition encounter your annual contribution limit, which will help you determine how often and how much you tin automatically invest.

- Cull the frequency and amount that works for you. Every little fleck counts. You tin can apply this Roth IRA calculator to estimate your business relationship balance when y'all retire based on how much you lot invest each yr.

- Brand certain to fill up out the section Invest in these funds. Check the box next to your Target Retirement Fund, and enter the total corporeality of your automatic investment. This ensures that your money actually gets invested each calendar month instead of just sitting in your settlement fund.

- Select keep and qualify the transaction.

Now what?

Yous're officially a long term investor – congrats!

All you have to do from here is permit the stock market place do its thing, and go on living your life. I recommend taking a look at your account in one case or twice a year and increasing your automated investment corporeality if y'all can. Y'all're allowed to invest up to $6,000 per yr as of 2021 into a Roth IRA, so try to make that a savings goal if it'southward not realistic for you lot right at present.

In one case you plow 59 ½, you can withdraw the money in your account and spend it on whatsoever you want without worrying virtually taxes. And if you need that coin early for some reason, check out How to access Roth IRA money penalty costless.

Happy Rothing!

Disclaimer: I am not a certified financial advisor and this article is intended for educational purposes just.

How To Add Money To Roth Ira Vanguard,

Source: https://www.readytoroth.com/vanguard-how-to-open-a-roth-ira-and-start-investing-asap/

Posted by: wyattblem1987.blogspot.com

0 Response to "How To Add Money To Roth Ira Vanguard"

Post a Comment